New U.S. inflation data is augmenting tech stocks listed on American exchanges, helping shares of cloud companies reach prices they haven’t been close to for nearly a year.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The new numbers on inflation indicate that the American central bank could soon halt its series of aggressive interest rate hikes, and if that causes interest rates to level off, it could spur investors to pivot their focus back towards tech shares. Given how far tech valuations have fallen in the past couple of years, any recovery feels welcome.

TechCrunch+ noted in late Q2 2023 that tech valuations were perking up, at least on the public markets. Today, following the new inflation data, a collection of cloud stocks tracked by VC firm Bessemer ticked 1.9% higher to reach gains of around 32% year-to-date.

TechCrunch+ noted in late Q2 2023 that tech valuations were perking up, at least on the public markets. Today, following the new inflation data, a collection of cloud stocks tracked by VC firm Bessemer ticked 1.9% higher to reach gains of around 32% year-to-date.

Inflation down, tech up

The past year has been tumultuous for many tech companies, which enjoyed attention from investors in an economic climate where low interest rates made them more attractive investments.

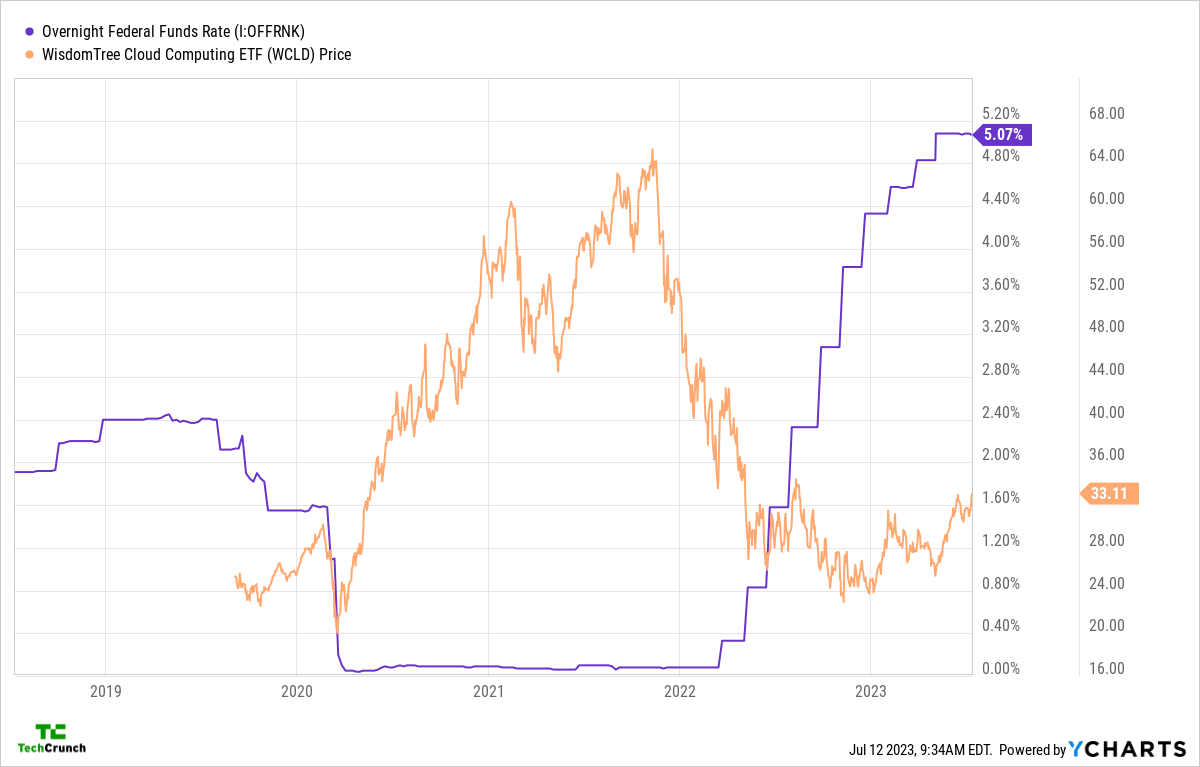

There’s a very basic trade-off between interest rates and growth-oriented companies. Lower interest rates engender lower bond yields, which makes for a less attractive investing climate for less-risky assets like bonds. At the same time, tech stocks, which are often valued based on their potential to grow quickly instead of their profitability, become more attractive as investors seek to maximize their returns.

A low interest rate environment also makes it cheaper for investors to raise money in the form of debt, which can bolster certain private equity strategies. In contrast, expensive debt makes private equity buyouts and other related transactions more expensive, potentially lowering market appetite to use debt to purchase and invest in tech companies. The end of interest rate hikes, therefore, could also help smoothen PE-led exit avenue for startups.

As interest rates have risen, the value of tech stocks has fallen. This chart compares the interest rate hikes with the performance of the Bessemer cloud index (WCLD):

Cooling inflation in the US brings slight relief to tech valuations by Alex Wilhelm originally published on TechCrunch