Bloom Money, a U.K.-based fintech, has raised £1 million to digitize an informal financial management system employed by ethnic communities across the world.

Often referred to as “rotating savings and credit association” (ROSCA), the model varies in the details around the world, but usually, it involves an informal gathering of people from a certain community who act as a bank, collecting and saving money that members can withdraw. The system is called different names across the world, such as “hagbad” in Somalia or “pardna” in parts of the Caribbean.

The goal is to avoid conventional banking systems, many of which discriminate against minority communities, especially in the U.K., CEO Nina Mohanty said. “Some of it is just blatant racism. We don’t have clear red-lining like in the U.S., but there are definitely postcode look-ups,” she said.

The ROSCA system is a way to conduct financial matters with people you trust, she said, “whether that is by race, nationality, we’ve even got people down to the tribe level.” Bloom Money wants to digitize this ROSCA process.

A daughter of two immigrants to the U.S., Mohanty says she decided to work on this problem after she moved to the U.K. and learned for herself just how difficult it can be for an immigrant to set themselves up financially. “I just felt that there was not just an economic justice point to this, but also a huge opportunity, where people only think of the U.S. as a country of immigrants, but increasingly across Europe, we know migration is growing,” she said.

Her co-founder and CTO Dan James believes in the system because he’s seen how effective it can be, growing up in an ethnic community in central Birmingham. “I saw first-hand the benefits that using ROSCAs can bring people, especially those entering the U.K. who have historically been underserved by the existing financial sector,” he said.

The company will use the funds from the pre-seed round to continue building its digital savings features, which has all funds safeguarded by an electronic money institution. The fundraising was led by Zinal Growth, and saw January Ventures, Pact VC, and angel investors Berenice Magistretti and June Angelides M.B.E. participating.

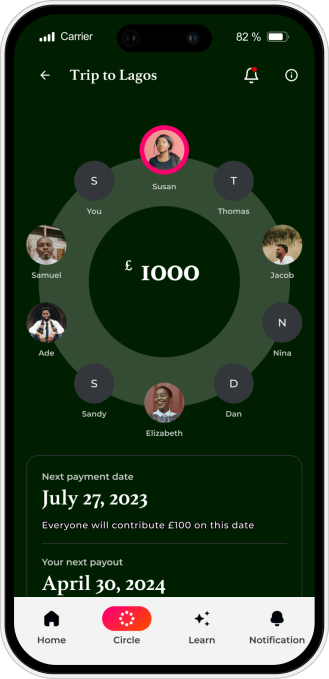

Bloom Money lets people create groups, known as ‘Bloom circles’, to share and save money with. It also has educational materials on the basics of life in the U.K., such as how to get a driver’s license, setting up a trust fund, and an explainer on credit scores.

Mohanty described the fundraising process as “really interesting.” She said the most challenging part was explaining to investors that the company intended to target very underserved communities. At first, there was a lot of misunderstanding, she said. “Some very racist, xenophobic things were said to us,” she said. “Even going through the regulation process, there was a lot of prejudice that we had to overcome.”

Mohanty and James say they wanted ethnic and gender diversity on their cap table, and they seem to have managed that so far: nearly 70% of their cap table identifies as women, almost 50% comes from a minority ethnic background, and about half identify as first or second-generation immigrants.

Angelides, an angel investor, said Bloom Money was her first angel fintech investment, and she knew right off the bat how big of a problem the company is trying to solve since she grew up in Nigeria, where cash is king. “Communities have struggled for generations with trust in financial systems and have preferred to use community-based saving methods, such as Ajo (the Nigerian version of the ROSCA system).”

“This comes with its own set of problems, from people absconding with funds to people being unable to significantly grow wealth. This is where Bloom Money comes in,” Angelidas added. “A lot of migrant communities remit large amounts to their home countries each year. With Bloom, they now also have an opportunity to build stronger ties with the U.K., grow their wealth and qualify for additional products that they ordinarily would have struggled to access.”